By Jill Cliburn

In light of wholesale PPAs in the U.S. averaging less than 3 cents per kWh, the utility solar market is booming with expansive solar possibilities. Today, there is even a strong case to be made for purposely over-building centralized solar resources and dispatching or curtailing them to ease the need for storage in a mostly-renewables world. Yet our work is still focused on local, community-scale solar—sometimes integrated with storage or load management.

Recently, someone asked me why I've been so dogged about solutions on the local grid. In response, I recalled how a few years ago, while our team was breaking new ground for community solar, I called our locally focused work "a market-based laboratory." That is still true and still exciting today. Work at the community scale provides specific solutions, replicable solutions and scaleable solutions—the benefits of which are just starting to unfold.

The headliner, 100+ MW solar projects are mostly new arrivals. California, Florida and a handful of other states led the trend toward big solar in 2019. Support for the solar industry nationwide still stands on a foundation built over decades on the appeals of local solar generation, such as energy-cost stability, resilience, environmental improvement, quality job creation, community education and recently, storage and clean electrification. Political support for solar remains strong in part because citizens can see community-scale projects nearby; solar is attainable by their own experience. Big solar follows in small solar's footsteps. I recall pushing for strategic utility PV beginning in 2005, when the U.S. had about 1 GW of grid-connected solar, despite a looming climate problem. Success then, as now, was solar at every scale. According to SEIA, utilities drive about 60 percent of the solar market today, but local solar, including residential, commercial and utility-partnership projects still make up a big share of U.S. total PV capacity—at 85 GW and rising.

Local solar, including residential, commercial

and utility-partnership projects still make up

a big share of US total PV capacity

Utility culture bends toward centralized solutions, but our world is changing. One indication is a new report from SEPA on integrated distribution utility planning, aimed at "multiple challenges with regards to visibility, tools and resources (e.g., skilled staff, investments) needed to manage a growing number of distributed energy resources (DERs)." The payoff comes for utilities, their communities and their customers if they can make the system work to optimize local value and control, while realizing the benefits of regional relationships, too. In the crucible of 2020, the public seems eager to strike the right balance between local resilience and upstream support for lots of things—including energy services. Local utilities, and especially the co-ops and munis that I have worked with, have investment and knowledge to apply to strategic solar and solar-plus. Non-utility developers and community stakeholders have key roles, too, but the best solutions will be collaborations.

A few examples might help. One emerges from our work with colleagues including DER leaders at the Sacramento Municipal Utility District (SMUD). As early as 2015, SMUD explored options for expanding its landmark community solar program. We explored high-value solar opportunities, such as well-oriented carports at schools or transit centers and a solar-enhanced mixed-income redevelopment project. Already, the falling cost of centralized solar was hard to beat. The utility made a strong cse for a green tariff type approach, which could bring solar to more customers faster at a lower cost. That is an argument that still haunts community solar advocates nationwide, who sometimes relent, as they did for a massive 1.5 GW community solar program launched last spring in Florida by FP&L.

At SMUD, the question of scale crystalized when home builders sought to address a new California law requiring all new homes to have solar. The builders argued that in some cases, new homes could not accommodate solar roofs or they would cost more than moderate-income home buyers could afford. SMUD offered community solar, drawn from big, remote solar projects as a solution.

But in this case, neither the regulators nor the community wanted to settle for solar that was simply cheap. They wanted it local, with options for strategic siting and operations that could enhance local grid value. In February 2020, SMUD delivered, and a new Neighborhood Solar Shares program was born. This program does not replace rooftop solar, but it offers a tree-friendly and fairly affordable option for new home buyers. Home builders and equity advocates statewide have said that this strategy breaks ground for community solar statewide, especially for lower income and multi-family home buyers. Regulators have insisted that such programs in investor-owned utility territories will face scrutiny, following existing California community solar guidelines with non-utility developers playing a lead role.

Solar plus storage has shown up first at the

community scale and often with voluntary support

through community solar-plus programs

Solar plus storage remains a tough nut to crack, but it has shown up first at the community scale and often with voluntary support from customers through community solar-plus programs. In a future blog, we will explore how SMUD applied the lessons of high-value community solar to its commercial StorageShares program.

The generic community solar-plus model deserves more attention, too. Some state community solar programs promise long-term savings based on an outdated assumption that all solar kWh are equal, while others are designed for flexibility, incorporating storage and/or demand response, as well as innovative financing, to assure long-term benefits. In 2018, the Municipal Light Department of Sterling, MA, launched the first hybrid, community solar-plus project in the state. Today, the Massachusetts Municipal Wholesale Electric Company (MMWEC) manages two solar-plus projects for Sterling, plus similar projects in four more communities. Building off experience, developer Run Raise Investments launched a 7.1 MW non-utility community solar-plus project in Massachusetts last year. This fall, New York announced its first community solar-plus-storage project. More are planned, including work by CUNY to overcome commercial real estate barriers and tap grid-locational benefits.

Recently, someone asked me why I've been so dogged about solutions on the local grid. In response, I recalled how a few years ago, while our team was breaking new ground for community solar, I called our locally focused work "a market-based laboratory." That is still true and still exciting today. Work at the community scale provides specific solutions, replicable solutions and scaleable solutions—the benefits of which are just starting to unfold.

The headliner, 100+ MW solar projects are mostly new arrivals. California, Florida and a handful of other states led the trend toward big solar in 2019. Support for the solar industry nationwide still stands on a foundation built over decades on the appeals of local solar generation, such as energy-cost stability, resilience, environmental improvement, quality job creation, community education and recently, storage and clean electrification. Political support for solar remains strong in part because citizens can see community-scale projects nearby; solar is attainable by their own experience. Big solar follows in small solar's footsteps. I recall pushing for strategic utility PV beginning in 2005, when the U.S. had about 1 GW of grid-connected solar, despite a looming climate problem. Success then, as now, was solar at every scale. According to SEIA, utilities drive about 60 percent of the solar market today, but local solar, including residential, commercial and utility-partnership projects still make up a big share of U.S. total PV capacity—at 85 GW and rising.

Local solar, including residential, commercial

and utility-partnership projects still make up

a big share of US total PV capacity

Utility culture bends toward centralized solutions, but our world is changing. One indication is a new report from SEPA on integrated distribution utility planning, aimed at "multiple challenges with regards to visibility, tools and resources (e.g., skilled staff, investments) needed to manage a growing number of distributed energy resources (DERs)." The payoff comes for utilities, their communities and their customers if they can make the system work to optimize local value and control, while realizing the benefits of regional relationships, too. In the crucible of 2020, the public seems eager to strike the right balance between local resilience and upstream support for lots of things—including energy services. Local utilities, and especially the co-ops and munis that I have worked with, have investment and knowledge to apply to strategic solar and solar-plus. Non-utility developers and community stakeholders have key roles, too, but the best solutions will be collaborations.

A few examples might help. One emerges from our work with colleagues including DER leaders at the Sacramento Municipal Utility District (SMUD). As early as 2015, SMUD explored options for expanding its landmark community solar program. We explored high-value solar opportunities, such as well-oriented carports at schools or transit centers and a solar-enhanced mixed-income redevelopment project. Already, the falling cost of centralized solar was hard to beat. The utility made a strong cse for a green tariff type approach, which could bring solar to more customers faster at a lower cost. That is an argument that still haunts community solar advocates nationwide, who sometimes relent, as they did for a massive 1.5 GW community solar program launched last spring in Florida by FP&L.

At SMUD, the question of scale crystalized when home builders sought to address a new California law requiring all new homes to have solar. The builders argued that in some cases, new homes could not accommodate solar roofs or they would cost more than moderate-income home buyers could afford. SMUD offered community solar, drawn from big, remote solar projects as a solution.

But in this case, neither the regulators nor the community wanted to settle for solar that was simply cheap. They wanted it local, with options for strategic siting and operations that could enhance local grid value. In February 2020, SMUD delivered, and a new Neighborhood Solar Shares program was born. This program does not replace rooftop solar, but it offers a tree-friendly and fairly affordable option for new home buyers. Home builders and equity advocates statewide have said that this strategy breaks ground for community solar statewide, especially for lower income and multi-family home buyers. Regulators have insisted that such programs in investor-owned utility territories will face scrutiny, following existing California community solar guidelines with non-utility developers playing a lead role.

Solar plus storage has shown up first at the

community scale and often with voluntary support

through community solar-plus programs

Solar plus storage remains a tough nut to crack, but it has shown up first at the community scale and often with voluntary support from customers through community solar-plus programs. In a future blog, we will explore how SMUD applied the lessons of high-value community solar to its commercial StorageShares program.

The generic community solar-plus model deserves more attention, too. Some state community solar programs promise long-term savings based on an outdated assumption that all solar kWh are equal, while others are designed for flexibility, incorporating storage and/or demand response, as well as innovative financing, to assure long-term benefits. In 2018, the Municipal Light Department of Sterling, MA, launched the first hybrid, community solar-plus project in the state. Today, the Massachusetts Municipal Wholesale Electric Company (MMWEC) manages two solar-plus projects for Sterling, plus similar projects in four more communities. Building off experience, developer Run Raise Investments launched a 7.1 MW non-utility community solar-plus project in Massachusetts last year. This fall, New York announced its first community solar-plus-storage project. More are planned, including work by CUNY to overcome commercial real estate barriers and tap grid-locational benefits.

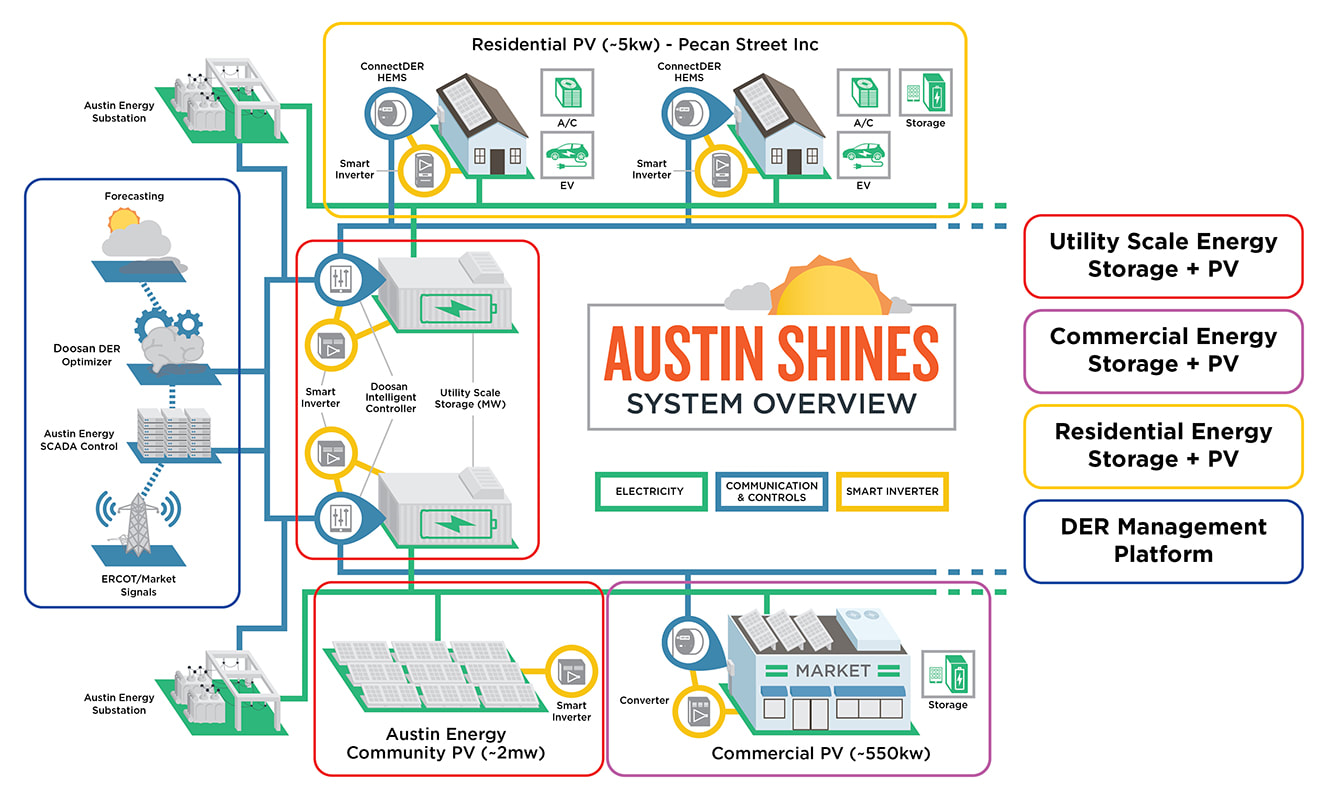

We will share more examples in upcoming blogs, but it is worth checking in with Austin Energy for a wrap-around vision of community-scale solar and DERs. In 2016, the Austin, TX, municipal utility launched Austin Shines to demonstrate a new way to assess net solar LCOE, taking into account how solar and other DERs together operate on the grid. The initial solar projects taht helped to launch Shines included a community-solar program array. Shines accessed grant funding for a 1.5-MW/3 MWH battery, but a project ecosystem has grown quickly with the help of public and private partners, demonstrating increasingly cost-effective and replicable integrated DER solutions.

The verdict is still out on how robust and fully integrated tomorrow's community-scale solar will be. But that is exactly the reason why I am still excited to be working with local utilities today. These are the market-based laboratories, where the value of solar, storage and other DER strategies are becoming better understood as key pieces in puzzle that is the decarbonized 21st century grid.

RSS Feed

RSS Feed