by Jill Cliburn

Our continuing work in development, policy and program design for high-value solar has kept us in touch with the questions from utility planners. As the longstanding solar investment tax credit (ITC) begins to wane and solar-plus-storage policies waver, we find that questions about timing are top of mind. If you didn’t start your solar-plus project already, can you make it work with next year’s lower ITC? Or, should you wait to see if storage-only tax credits take shape in Congress? If successful, a storage-only tax credit could add flexibility for charging from the grid and eliminating the need for solar and storage to advance together, like awkward cousins in a three-legged race.

As we look into the CSVP crystal ball, we see clear indications for this answer: Start now with a good project concept, and it can only get better.

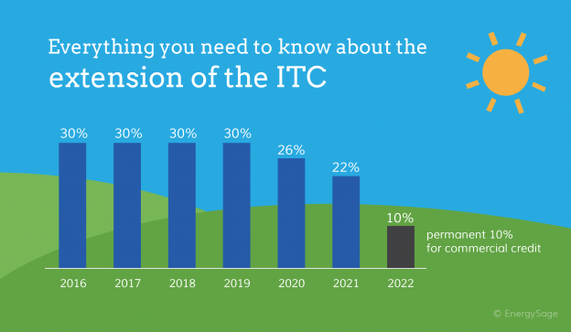

The step-down schedule for the solar and solar-plus-storage ITC is widely known. Projects that are legitimately under construction by year-end 2019 will receive the 30% ITC, which has been in place since its last extension in 2016. Projects under construction in 2020 suffer a 4% drop in the ITC, with another 4% drop in 2021, followed by a return to the standard 10% commercial investment tax credit.

For solar-plus-storage projects, the IRS has provided additional guidelines, outlined in this factsheet from the National Renewable Energy Lab (NREL). Remember that, in some cases, a Modified Accelerated Cost Recovery System (MACRS) depreciation deduction may apply, as well, adding to the total project benefit. A co-located solar-plus project must charge the battery with solar at least 75% of the time, while the tax credits are paying off, in order to qualify; in some locations that is tricky. But anxious utility managers may find solace in a simple formula that predicts how much of the tax credit would apply with success on a yearly basis ranging from 75 to 99.9%.

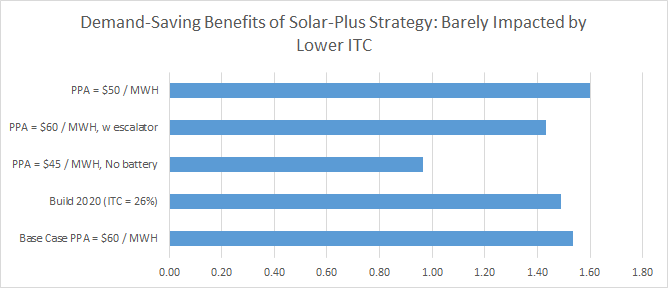

In short, the solar-plus-storage ITC is a good thing. Starting a project now reduces your chances of leaving ITC and MACRS money on the table. For the many utilities that cannot take advantage of tax incentives directly, either because they are non-taxable or because of state normalization rules, your first step may be to explore financing options that let you take advantage of these benefits through development partnerships. The simplest of these is a Power Purchase Agreement (PPA), which has a long track record on the solar side. On the storage side, an Energy Storage Service Agreement (ESSA) is the likely instrument. Similar in some ways to a service lease, the ESSA may target one or more use cases and give the provider some leeway in how to meet your bottom-line needs. See CSVP resources on financing and early-stage storage planning.

It is a common mistake to focus on incentives instead of on bottom-line needs. Utilities and stakeholders alike may have a hard time seeing deep inside storage and solar-plus-storage business models, but the best providers rely on a team of market-watchers and risk-managers to figure out how a kaleidoscope of changing technologies, supplier-pipeline conditions, policies and investor requirements affect the bottom-line project offer. During the RFP process, it is crucial to assess each potential provider’s business record and technical qualifications. When stuff happens—and it usually does—you want to know your developer can rework parts of the plan, to achieve your key goals.

Should you be tempted to wait for the storage-only incentives that Congress began to consider last fall? In late March 2019, three new, bi-partisan energy storage bills were introduced in Congress, according to Utility Dive. One would amend the Public Utility Regulatory Policies Act (PURPA) to include energy storage. Another assures that more storage projects would be eligible for loan guarantees, and a third increases federal support, primarily for energy storage R&D. Tax incentives for storage currently are not on the table, though some utilities might snag new grant of loan funding.

Utilities may turn attention to storage market developments that continue to drive price declines. According to a report from Bloomberg New Energy Finance, lithium-ion battery storage costs have declined 76% since 2012. Other sources, including Wood Mackenzie GTM, note that the stunning annual price reductions seen five years ago have subsided, but storage prices continue to decline at a more sustainable rate—around 5 to 10% year on year, including reductions in pricing for both battery technologies and balance of system components—not to mention continuing solar-price reductions. Clearly, there are more ways to reach a bottom-line target than to take a laser-focus on the ITC.

Any number of crazy things could happen to steer a solar-plus project off course. Supply-chain disruptions are characteristic of emerging markets. Who knows how the tariff story will play out? Who knows how mergers and acquisitions in this market may affect a particular project? And who knows if something as weird as the weather could wreck havoc on your solar-plus plans?

But most signs point to the emergence of a solid storage industry and to continued growth in renewables—especially solar. In an effort to meet rising renewable-energy targets nationwide, utilities have to get down to what CSVP has called the “market-based laboratory,” to learn how to add value to solar and storage and to meet customer needs in a fast-changing market. An extension of the solar-plus ITC or emergence of more storage-only incentives may come, as a ways to speed the utility energy transformation along, but the impact of any one market condition upon this industry is neither predictable enough nor impactful enough to stop a good project plan from moving ahead.