A just-released 2019 U.S. Solar Market Insight report from SEIA and Wood Mackenzie predicts, “By 2023, roughly 30% of total non-residential PV capacity will come from community solar, and 20% of all non-residential capacity is expected to have storage attached.” This prediction resonates with the view we expressed last summer, that the market for community solar-plus is rumbling and ready to rock the industry, before a lot of community solar planners and developers can get their socks on.

It’s exciting, but also a risky time—especially for municipal utilities and co-ops that are still on the learning curve about solar PPAs and storage operating agreements, even as they are negotiating their place between upstream wholesale providers and downstream customer/advocates.

How do you get through it? At CSVP, we have always recommended a collaborative process, and our Solutions process seems more apt today than ever. But in addition, we can offer some newsy additions.

Recently, our friends at the Rocky Mountain Institute (RMI) Shine Program opened a website focused on community-scale procurement. It is aimed to support solar in the 1- to 10-MW range. Recommendations were refined over a series of procurements in 2016-18, which RMI supported for utilities in Colorado, New Mexico, Texas and New York. Those experiences are documented in its report, Progress and Potential for Community-Scale Solar.

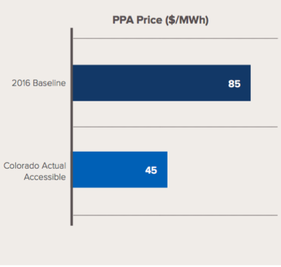

In short, RMI’s hypothesis about the value of buy-side consulting to facilitate solar procurement proved true. Its process has secured attractive PPAs, including a run of community-scale projects in the $45 to $55/MWH range. Specific strategies, which RMI calls “levers,” can be credited for much of this success. They range from increasing the utility's contribution (for land, interconnection, etc.) to facilitating better communications between utilities and bidders, to applying effective techniques between the short list and the final negotiation and encouraging group deals among utilities. In discussing these strategies with RMI program manager Kevin Brehm, it is clear that the outcomes generally exceeded expectations. Yet they also hit a few bumps. For example, the challenges of pulling off a group deal among locally-controlled entities often prevent utilities from realizing full economies of scale. Also, a recent RMI procurement process that included solar plus storage revealed reluctance among bidders to deal, at least at this stage of market development, with RMI’s analytic requirements and streamlined terms. (We return to that topic below.) While anticipating further refinements, the Shine project website will focus on solar projects, except to report on solar-plus in its case studies.

A full set of storage case studies, plus plain-English explanations of storage technologies, use cases and economics, are featured in a new guide, Battery Storage Overview, released this summer by the co-ops. Co-authors include National Rural Electric Cooperative Association (NRECA), National Rural Utilities Cooperative Finance Corporation, CoBank, and National Rural Telecommunications Cooperative. This guide complements the solar development resources already housed on NRECA’s SUNDA project website. It includes an explanation of the levelized cost of storage (LCOS), accompanied by a real-world example, to show how still-costly storage can alleviate wholesale demand costs. It suggests lithium-ion storage for a (not unusual) utility, paying $12/kW/Month for demand, $22/MWH for energy, producing benefits that “payback” in 8 years. In this scenario, the utility would buy the battery. Beyond the economics cited, this hypothetical project might further improve cost-effectiveness by tapping resilience value, grid deferral, or other integration values.

A municipal utility example, aimed at demand cost reduction, was recently updated by the North Carolina Clean Energy Technology Center. The (NC CETC) solar program worked with the Fayetteville (NC) Public Works Department on a community solar plus strategy. It uses a purchase model, in contrast to another muni-based community solar-plus program at Sterling (MA) Light and Power, which used a PPA. Fayetteville aimed to make its project work without access to the ITC. With analytic support from NC CETC, Fayetteville was able to procure a relatively small, 500-kW/1MWH lithium-ion battery, along with a 1-MW solar array. Community solar economics are shouldered fully by program participants, while the battery serves all ratepayers. Demand-savings provide a 10-year payback, before counting any extra storage-related values.

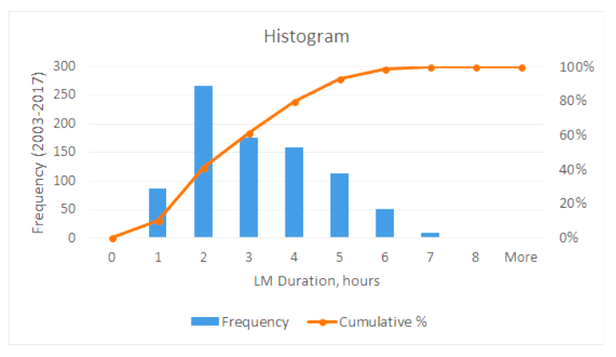

A spotlight poster presentation at Smart Energy Week last month described how NC CETC modeled the time and duration of likely utility peaks, using multi-year data. After analysis, the utility decided to trade perfect peak-demand avoidance for avoidance around 80%. With that, the utility could acquire the battery now, for a full program launch this fall. This is an important lesson for smaller utilities that want to gain battery experience. Such utilities can work on a demonstration scale and still reap savings. That is true, even as NREL predicts that regional markets with increasing renewables will find 4-hour batteries—or even 8-hour batteries—necessary to fully address their widening peaks in future years. The storage value proposition is likely to play out differently at the local level than from the regional bird’s eye view. Local utilities may be first to optimize storage and load flexibility, revealing values that analysts can barely see from afar.

None of the resources referenced above fully address one key problem that many utilities face as they venture into the battery storage market. That is, how do you estimate and evaluate the battery storage agreement and options for dispatch support? As CSVP reported last year, this is a prescient question.

The combined costs of solar-plus storage agreements that have been reported on fairly large projects, have been compelling. The 2018 Utility-Scale Solar Markets report from Lawrence Berkeley National Labs reported multiple solar-plus battery projects where the added cost of batteries over solar alone was just $5 to $15 per MWH. The same analytics do not apply at the distribution scale. However, the buzz around smaller-projects last year suggested that well-designed battery agreements, combined with good forecasting on the solar-generation and demand side, can produce strong net economics for community-scale projects, as small as 1 MW/2 MWH. Small projects are do-able, but there is still a lack of information readily available, without relying on peer-to-peer networking.

Consultants on our team recently proposed a new collaboration to improve the understanding and use of solar-plus PPAs and storage agreements. Based on discussions with a half-dozen utilities and as many technology experts and providers, we’ve concluded that the need for best-practices and guidance in this area is delaying more widespread solar-plus-storage success.

For now, there are a few limited but helpful places to turn. The Clean Energy States Alliance, (CESA) has spotlighted utility-based solar-plus projects and touched on the challenges, costs and benefits of storage agreements. CESA works closely with the team at Sandia National Labs, showcasing Sandia’s state-of-the-art analytics—still unfortunately out of reach for a lot of local utilities. NREL also continues to refine its ReOpt analysis tools for solar and storage integration. And industry groups like the Peak Load Management Alliance integration forum have hosted some dialog between solutions providers and utilities. Much more of that dialog—before, during and after procurement—is needed to assure the best community solar-plus project outcomes.