As we examine the landscape for new utility “solar plus” projects, along the lines of community solar combined with demand response (DR) or storage, we realize that one of the more compelling reasons why utilities should pursue a this type of program is that a growing number of non-utility companies are already working in this market space. On the East and West Coasts and in some places in between, there is a burgeoning industry around integrated demand-side management, including DR, storage and distributed renewables. Innovative third-parties are giving electricity customers increasingly better tools to cut demand charges, modernize operations and reduce overall bills. For utilities that choose to watch from the sidelines, the fracture in the traditional utility-customer relationship drives deeper.

For example, GreenCharge Networks (GCN), with offices in Silicon Valley, New York, and San Diego, provides “intelligent energy storage” solutions-management services for onsite generation, energy management systems, DR, and storage. GCN installs integrated battery systems in large buildings and institutions nationwide. Recognizing that these systems can greatly expand the value of solar in mitigating utility demand charges, GCN is specifically targeting commercial solar sites. It is not adverse to utility partnerships, however—should the utility ask—as proven by recent work in collaboration with Duke Energy.

What about the arguments that storage is prohibitively expensive? Earlier this year, GCN secured financing to offer no-money-down battery systems to customers. And, GCN is not the only one providing this innovative financing model. Stem, a primary competitor to GCN, headquartered in Milbrae, CA, also offers a behind-the-meter demand-charge mitigation storage tools.

Companies are also making innovative software platforms to handle the increasingly evolving ecosystem of devices and hardware available for customer energy management. Geli’s hardware and software helps manage microgrid and EV-solar battery integration projects. The platform optimizes for complicated use-cases, involving multiple on-site assets, focusing on solar-plus-battery sites. Geli models the technical performance and financial impacts of installations, with market-specific information on how the system impacts utility tariffs and demand charges.

The takeaway is not that every utility should attempt to undertake innovative, complex integrated demand-side management projects on its own. Instead, it is that there is a growing customer appetite for more holistic energy management. In fact, this growing appetite is more important than any specific end-use solution. Once a customer has embarked upon this path with one service provider, that customer is unlikely to abandon that path completely and to start work with a whole new partner or partners. Continuity is valuable to these customers. That’s why the utility must show up now and join in, before it’s too late.

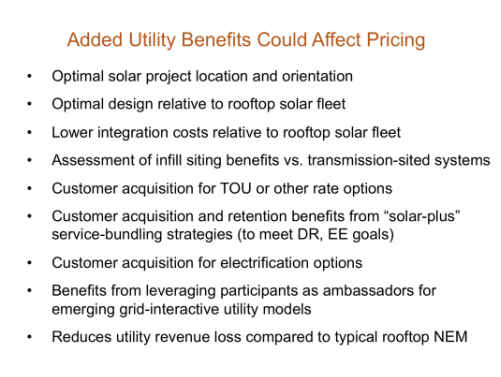

We’ve found that the utility has unique comparative advantages, which may be leveraged with the customer during this early-stage window of opportunity, irrespective of what other offers may be on the table by third parties. Utilities need to think clearly about what kind of a service packages they can provide to meet their customers’ needs. Often this will involve technical partners and initial pilot projects—in fact, projects that might include community solar, designed to include key stakeholders and technical partners. But utilities need to get serious about addressing this growing market, because if they don’t, somebody else will.

Erich Huffaker, a Project Specialist at Olivine, Inc. will be departing the CSVP Team this month as he pursues diverse professional interests and a penchant for travel. He recently coauthored the CSVP guide, Integrating Demand Response Into Community Solar Programs. We will miss him and look forward to his future dispatches.